SBI Balance Check Number

Assuming you own an SBI account, checking its balance can be completed using various means. Instead of visiting in person, an easier alternative would be calling SBI’s toll-free number or by SMS and/or online accessing Mini Statements which offer balance checks as well as accessing other services offered by this bank. Here we explore more than these approaches!

There Are Numerous Methods of Confirming SBI Account Balance There are various approaches available for checking an SBI accounts’ balance quickly before going deeper – let’s review some popular ways that could quickly provide answers –

SBI Balance Inquiry Methods, Numbers/Links/Codes [912376666666,912376666667], Missed Call Service on 92376666666; SMS Service at 092376666666;

Internet Banking on SBI Online. Visit their Official Site

Download the YONO Retail Customers Application on Mobile Banking in order to start banking from home!

Download and Install the Yono LITE App (Retail Customers).

YONO Business App for Corporate Customers.

WhatsApp Banking/USSD Codes, along with WhatsApp Banking/USSD Codes*595# can all provide another method of checking your SBI balance, but we will go further into detail below regarding how this may be accomplished by visiting any local branch/ATM to examine its balance in person. Let’s go over each method step-by-step!

Are You Searching for SBI Balance Check Toll Free Number? Here is the comprehensive list of available numbers you may dial.

Call these numbers free of charge in order to find out the balance in your account: 1800 1234 1800 2100 18 11 22 11 16 917 18 425 3800. Located here.

SBI Balance Enquiry Numbers

Below are numbers to call to inquire about your SBI account balance by way of missed calls or SMS services, via your registered mobile phone.

Check Your Balance by Calling 922237666666.6. Send “BAL” as SMS Text message or miss your call by dialling 0922238666666.6 and enter “MSTMT” for mini statement text message service.

Missed Call Banking allows for convenient account checking through missed call. From managing SBI balance check numbers miss statements calls or mini statement calls all the way up to balance check numbers miss calls they can all be found here.

Missed Call Service/Mini Statement and Balance Enquiry. It’s free, available across multiple accounts linked with SBI and accessible with only your mobile number registered to SBI accounts for use with its missed calls service.

Are You Searching For “SBI Missed Call Balance?” Here Are Steps To Sign-Up To SBI’s Missed Call Services

How Can I Register with SBI Missed Call Banking? Before using the State Bank of India missed calls service, registration needs to take place once. Follow these steps in order to complete it successfully and complete registration with them.

STEP 1: Send an SMS using your account phone number (922348888888888888888). Your SMS should contain information pertaining to REG Account Number as stated above.

STEP 2. Once completed, a confirmation message regarding your registration status will appear in your inbox.

If you need assistance verifying your balance in State Bank of India accounts, call to 09222376666666 on your cell phone to check its balance.

How to Check SBI Balance Through SMS Additionally, you can check the balance of your account via an SMS sent directly from the mobile number associated with it.

Here are the keywords and phone number required to use SMS as part of this service.

How to Check SBI Account Balance Online

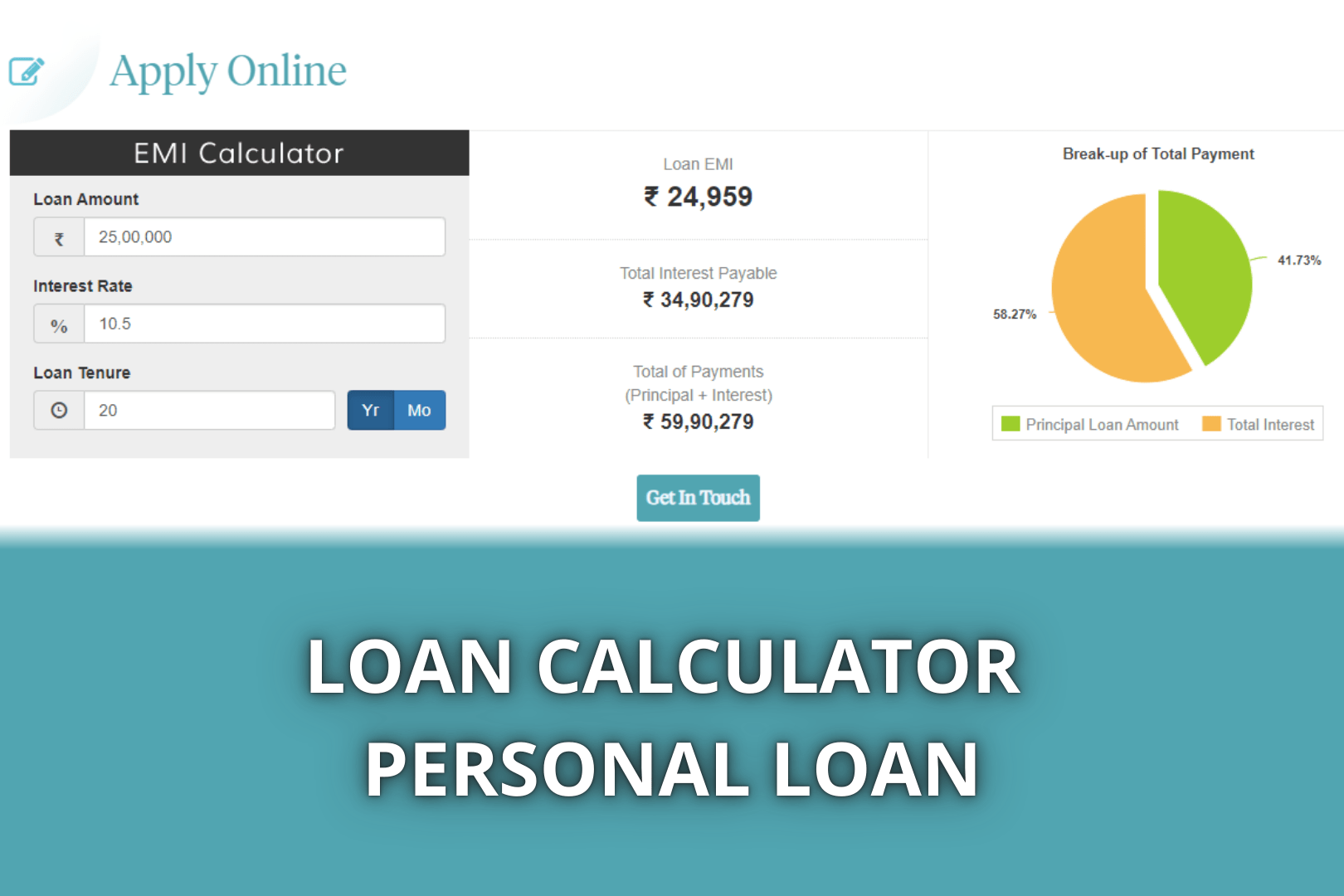

SBI account holders have access to online banking for various transactions including balance inquiries as well as mortgage loans, home loans, funds transfers and individual loans – just to name a few! When signing up with online banking they have full control of completing these tasks without leaving home! With online banking they have full access to various bank services for balance inquiries along with various financial transactions including loans for mortgage, home and personal use as well as balance inquiries!

Your search for an “SBI online balance check” has come to an end.

Follow these steps to register and use SBI Net Banking Facility:

Step 1. Navigating through to Personal Banking section on SBI Website, click New User Registration button.

Step 2. From the drop-down menu, choose New User Registration before pressing Continue.

Step 3. A user-driven registration form appears. Enter your bank account’s details such as CIF number, branch code and account number into it before providing mobile number registration details and facility type preference before filling in captcha information and clicking ‘submit and send”.

Step 4. On another page you must type the OTP you received via mobile and select “Confirm”.

Step 5. If your ATM card allows it, then enabling net banking can be accomplished through validating it; otherwise the branch can do it for you.

Step 6.To access an ATM account, choose it, fill in its required details, and press ‘Proceed’.

Once approved for net banking service, an approval message will appear on your screen.

Step 7. To continue, create your username permanently by returning to the login page.

Step 8. Select an available username and create a strong password before signing into your account.

SBI Account Balance Check With Mobile Apps

State Bank of India offers its customers mobile banking services through multiple apps on mobile phones. Aside from checking balance, users are also able to perform numerous other functions using these applications such as paying bills.

Missed Call Services

SBI Quick is a free service that lets you check your account balance Mini statement balance, Mini statement balance and more by making missed calls or SMS. In order to use these services you need an unanswered call or SMS from a registered mobile number which does not receive these services in response.

Downloading apps through either Play Store or App Store makes accessing services without an internet connection much simpler, eliminating individual number recall. Once installed, these services become easily available without being dependent upon an active internet connection for their usage.

Important to keep in mind is the fact that an application isn’t needed in order to access these services.

Retail Banking through Mobile Applications SBI’s YONO Personal and LITE SBI mobile apps for retail banking offer users safe, simple and user-friendly banking on the move without plastic cards or paper statements being necessary.

SBI YONO Business for Corporate Banking

This app from State Bank of India specifically caters to business customers by connecting financial accounts and performing transactions using mobile phones.

Your mobile banking can assist with large transactions, tax payments and all the requirements associated with corporate banking.

Check SBI Balance Via UPI

These days we all use UPI applications to pay for purchases; but did you know you can also use these apps to check the balance in your SBI account via UPI apps? Below are steps on how you can determine an SBI account balance via UPI apps.

Step 1. Open up any UPI application of your choosing and sign in using your SBI account details.

Step 2. Select “View Balance or Check Balance,” depending on which option is available in your application.

Step 3. Select an SBI account you would like to verify.

Step 4. Enter Your UPI Number (UPI).

Step 5. Your balance will appear on your phone’s display screen.

Balance Inquiry via State Bank of India WhatsApp Banking WhatsApp has quickly become the go-to app for staying in contact with friends and family – not to mention banking! – but now also gives us access to checking our balance through state Bank of India! Simply follow these instructions for sign-up then utilizing WhatsApp Banking / Balance Enquiry through SBI WhatsApp Banking by following these simple instructions for balance enquiry using State Bank of India WhatsApp Banking

Step 1. Send an SMS using “keyword” as the subject to +917208933148 with your registered mobile phone to enable WhatsApp Banking Services on your account.

Step 2. Optionally add this number (+919022690226) to your contacts, then send an introductory WhatsApp message from the mobile number you registered as being used for registration to this number and say hello from there!

Step 3. Once the conversation begins, a welcome message along with several shortcut buttons will be presented to you.

Step 4. Click “Find Balance” to review the status of all SBI Accounts balance.

Step 5. Your balance will be sent via WhatsApp chat.

Make Sure To Utilize USSD Codes For SBI Balance Enquiry

USSD codes offer an excellent means of checking the balance in your account without an internet connection, providing free SBI Balance enquiry without cost to customers. Please follow these steps if using USSD codes to discover your SBI balance without cost.

Step 1. Dial 595# and provide your User ID number.

Step 2. Select “Option 1” from the Answer menu.

Step 3. Select “Balance Enquiry.”

Step 4. Before sending, enter your MPIN. Finally send.

Step 5: Your SBI Account Balance should appear on your phone’s display.

Balance Enquiry from ATM

SBI account holders can utilize the ATM-cum-debit card they were given as part of their accounts to inquire into the balance in their accounts through any ATM of any bank – be it SBI’s own ATMs, or those belonging to other banks – by following these simple steps at an SBI ATM or any other.

Step 1. To swipe your SBI ATM/debit card.

Step 2. Enter Your ATM PIN

Step 3. From the drop-down menu, choose ‘Balance Enquiry”.

Step 4. Your account balance will now appear.

Make it easier to keep track of recent transactions by selecting “Mini Statement” at an ATM and receiving a receipt that contains transactions from within 10 days.

Remember, RBI has set a limit for free transactions per ATM card each month; balance inquiries and ATM card usage also count as transactions. Once this limit has been exceeded, any further transactions conducted will incur fees; for each one undertaken during any given month they’ll incur an administrative charge fee.

SBI Balance Enquiry Via Passbook

When opening an account at SBI, a passbook was given to you for easy record keeping of transactions pertaining to credit and debit balances. Simply visit any branch to bring this passbook up-to-date or to view an accounting of transactions between credits and debits.

SBI Balance Enquiry for Credit Card Users Users with SBI credit cards can utilize SMS tools to monitor their balance as well as access other details of services available via their card account. Take a look at this table for further details of these offerings from State Bank of India (SBI).

Note that “XXXX” indicates the final four digits on your SBI Card number.

Send SMS Format Number to Check Balance/Block Card/Check Credit : 5676791 (Check Your Balance or Block Card, Cash Limit/ Check Credit or Both ).

Last Payment Status was 5676791

Why Check Your Account Balance Regularly (Part One and Two)

Monitoring the balance in your account on a regular basis will allow you to stay abreast of daily transactions and ensure a more seamless financial life experience. Here are additional reasons for regularly monitoring its balance:

Make sure that the account has enough funds available in it in order to cover payments such as transfers or bill payments, etc.

Determine whether money was credited to an account promptly

To ensure that any amount deducted for an unsuccessful operation has been paid back in full.

Determine whether an institution has made payments of interest at their appropriate dates.

Keep track of any unnecessary expenditures by creating an inventory system to monitor spending costs.

Keep track of your spending to create an accurate budget by monitoring spending habits.

Conclusion

Constantly checking your balance is vital for sound financial management, and SBI makes this easy with various means available to check it. Checking online bank accounts, mobile phone or even calling one of these toll-free numbers (1800 1234, 1800 2100/1800 2100/11 2211/1800 425 3800 or 080-26599990 are amongst them.

Check your balance regularly and keep an eye on ensuring a stable financial situation.