HDFC Bank Marriott Bonvoy Credit Card: Enjoy Luxury Travel & Rewards

Apply for Instant HDFC Credit Card

Needing incredible travels and luxurious hotels? The HDFC Bank Marriott Bonvoy Credit Card may be your solution! Earn points, receive free stays and even upgrade to higher statuses with ease; making travel experience all that much better than before! But is this card right for you and your spending habits? Read more now to determine this for sure.

Earning Marriott Bonvoy Points: An In-Depth Look

Earning points with this card is key; more points means more free nights and other cool perks you can access. Let’s discover more on how they work!

Spending Categories and Point Multipliers

Your purchases help build points quickly. Marriott hotels make this easier still with additional points earned with every rupee spent – for instance, every Rs150 spent can earn six at Marriott; everyday spending may only yield two points for that same amount spent elsewhere. With such an aggressive point-earning structure in place, points balances can quickly grow over time!

Welcome Bonus and Special Promotional Offers are currently available to members.

New cardholders usually qualify for a welcome bonus that could total tens of thousands of points after spending certain amounts over their first few months. Also keep an eye out for limited-time promotions offering increased earning rates or special deals to significantly accelerate point earnings.

Maximizing Point Accumulation

Be smart about where and when you spend. Use your Marriott Bonvoy card for stays and bonus categories at Marriott hotels to maximize points earned, check for promotions offered, then plan spending to maximize them; these strategies could make an incredible difference in how fast rewards accrue!

Unlock Exclusive Marriott Bonvoy Benefits Now

This card provides more than points; it unlocks special perks to make your travels truly extraordinary and create lasting memories from them.

Enjoy complimentary Marriott Bonvoy Silver Elite Status seating with this offer!

As a cardholder, you automatically qualify for Silver Elite status with Marriott Hotels and can enjoy its benefits such as priority late checkout and bonus points on stays – sometimes you even receive enhanced room upgrades! These perks add greater value to your Marriott stays!

Anniversary Free Night Award

Every year, Marriott hotels give out free night awards that you can use across their global portfolio of hotels. Each certificate carries points redemption value that allows you to take advantage of this award and experience their excellent services without cost! Just imagine enjoying one of their incredible hotels every year.

Find Other Marriott Bonvoy Perks

Enjoy member rates when booking directly with Marriott and mobile check-in to streamline arrival, plus exclusive experiences that add an extra dimension to your trips.

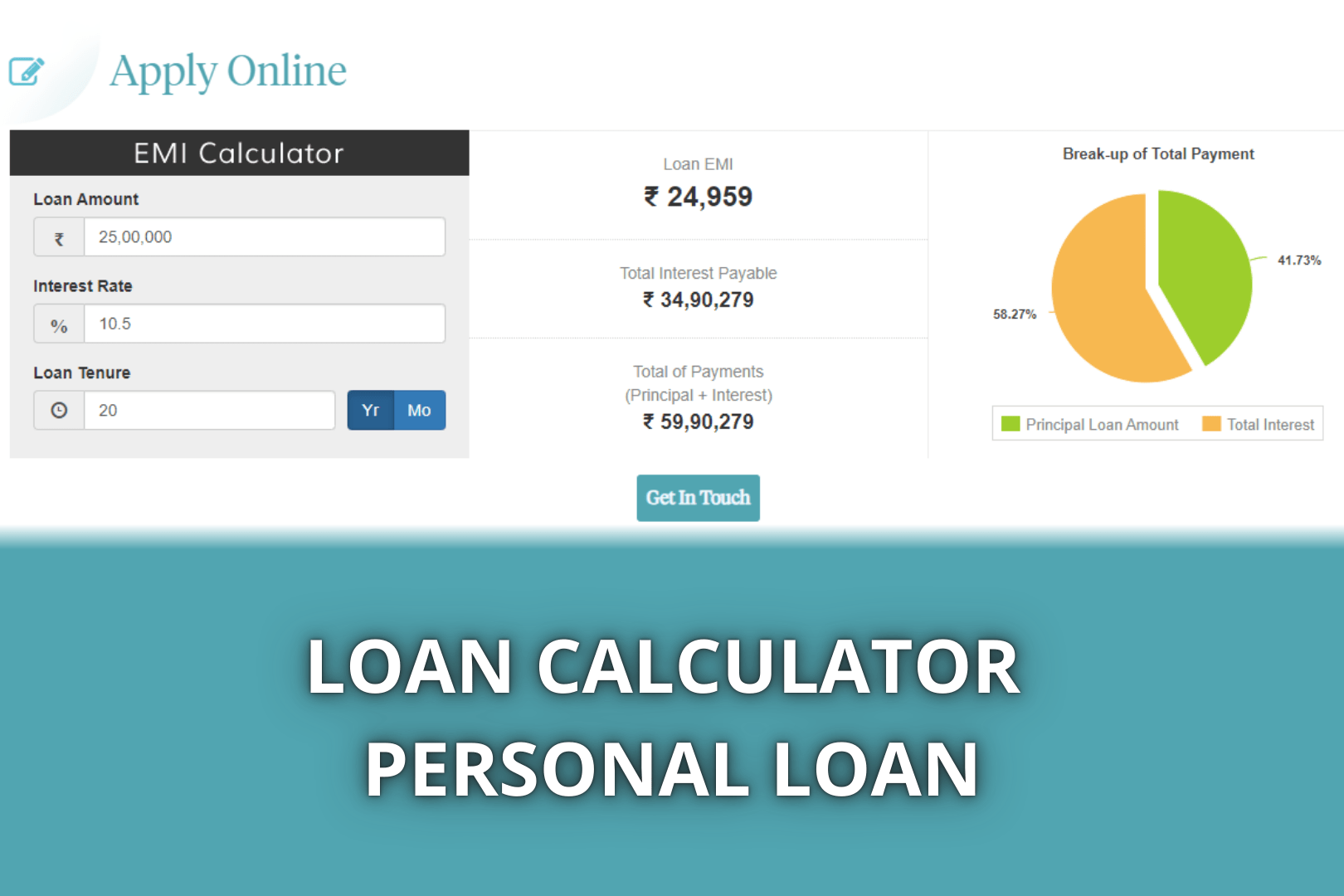

Fees, Charges and Fine Print: What You Should Know

Understanding all associated costs is paramount to making an informed decision and can assist with making an educated choice when purchasing credit cards. There may also be associated fees attached with each card you acquire.

Annual Fee & Renewal Benefits

Check if renewal benefits outweigh costs before renewing a card that requires an annual fee, such as offering bonuses or credits that could potentially reduce costs over time. Carefully evaluate their potential impact.

Late Payment Charges and Interest Rates for Overdue Accounts

Keep a low balance and pay on time to reduce interest charges and prevent late payments that incur fees – this should be your goal for optimal savings! Keep this point top of mind to help avoid these unnecessary costs.

Fees & Other Charges Related to Foreign Transactions

Be mindful of foreign transaction fees if using your card abroad, or other charges may apply depending on how and what transactions take place. Careful reading will enable you to fully grasp all potential costs. Being informed ensures you remain fully informed.

Are You an Ideal Candidate for an HDFC Bank Marriott Bonvoy Card?

Decide whether this card fits with your lifestyle and travel plans before applying. Some cards may be better-suited to certain individuals than others – do your research first before making your application!

Ideal Cardholder Profile

This card is tailored for frequent Marriott guests who regularly spend on travel and dining expenses; those loyal to the Marriott Bonvoy program might find this suitable as it supports loyalty with rewards programs like Marriott Bonvoy.

Alternative and Competitor Cards

Compare their benefits and earning structures before selecting one that best meets your needs – don’t settle without first conducting proper research!

Application Procedure and Eligibility Criteria Criteria (APECC).

Application process for personal loans is generally straightforward; simply meet certain requirements like income and credit scores to qualify. Check eligibility by verifying you meet requirements before starting to fill out an application.

Conclusion: Elevate Your Travel with Marriott Bonvoy

The HDFC Bank Marriott Bonvoy Credit Card can enhance your travel experiences. Offering fantastic travel experiences and rewards, if luxury travel is your goal then this may be just what’s needed to reach it. Before applying, take time to consider your goals and spending habits carefully and plan for success before applying.