Unlock Financial Flexibility with IIFL Personal Loan: Your Comprehensive Guide

Personal loans in India are growing fast. They help cover big expenses like medical bills, travel, or education. Choosing the right lender makes all the difference. IIFL stands out because of its great features and customer-friendly way of doing business. This guide will walk you through eligibility, features, how to apply, and tips for borrowing responsibly.

Understanding IIFL Personal Loan

What is an IIFL Personal Loan?

An IIFL personal loan is a flexible loan that you can use for many needs. Want to pay for a wedding? Or maybe cover an unexpected medical bill? IIFL offers loans up to ₹25 lakh. These loans help you meet your financial goals without collateral. What’s special about IIFL? They provide quick approval, transparent charges, and flexible repayment options.

Loan Amounts and Tenure Options

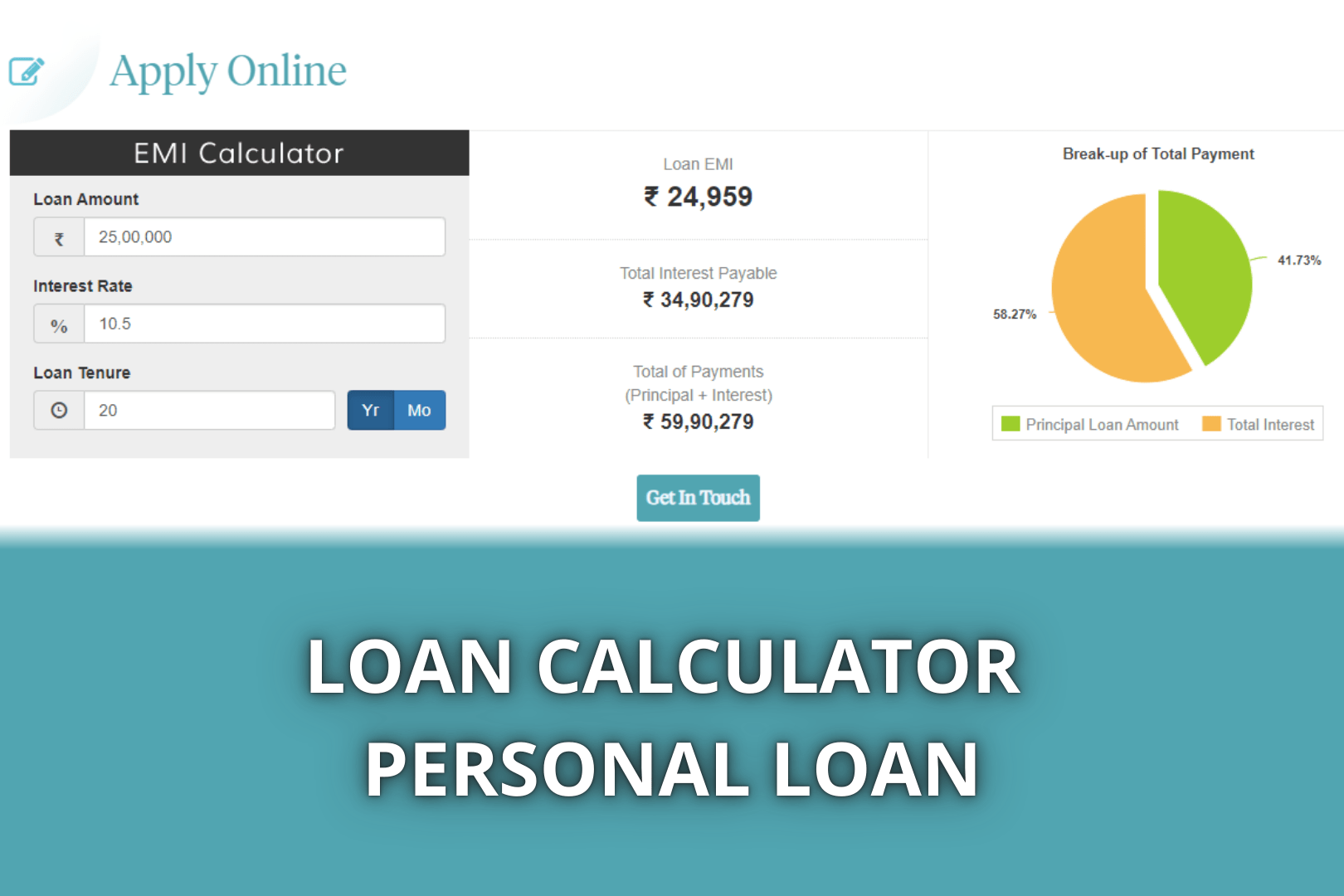

Most IIFL personal loans go up to ₹25 lakh. You can choose repayment periods from 12 months to 60 months. Longer tenures often mean smaller EMIs but more interest paid over time. Shorter tenures result in higher EMIs with less total interest. So, pick what fits your budget and financial plans.

Interest Rates and Processing Fees

Interest rates for IIFL personal loans are competitive. They can be fixed or floating, usually ranging from 10% to 20%. Processing fees are minimal but vary based on loan size and tenure. IIFL also allows prepayment, so you can clear your loan early without heavy penalties. Keep in mind that prepayment charges may apply, so review the terms carefully.

Eligibility Criteria and Documents Required

Who Qualifies for an IIFL Personal Loan?

Most borrowers aged between 21 and 60 qualify for an IIFL personal loan. You need a steady income and a good credit history. Employment status matters—salaried individuals and self-employed professionals both can apply. Your credit score should typically be above 700 for a smooth approval.

Necessary Documentation

Prepare these to speed up your loan approval:

- Identity proof (Aadhar, PAN card)

- Address proof (passport, utility bills)

- Income proof (salary slips or bank statements)

- Employment details or business proof

- Bank account statements

Tips for Meeting Eligibility

Improve your chances by maintaining a good credit score. Clear past debts, make timely payments, and avoid multiple loan applications at once. Also, gather all documents beforehand to avoid delays.

The Application Process

Step-by-Step Guide to Applying

Applying for an IIFL personal loan is easy. You can do it online via their website or mobile app. Fill out the application form with your personal and financial details. You may also visit an IIFL branch if preferred. The process is simple and quick.

Approval Timeline and Disbursement

Most applications get approved within 24 to 72 hours. Once approved, funds are transferred directly into your bank account. You can expect to receive the money via NEFT or IMPS, often within a day or two.

Common Reasons for Rejection & How to Avoid Them

Low credit scores, insufficient income, or incomplete documents cause rejection. To improve approval chances, pay debt on time, maintain a steady income, and double-check your paperwork before applying.

Comparing IIFL Personal Loans with Competitors

Key Differentiators

IIFL offers competitive interest rates and flexible repayment plans. It provides a streamlined digital experience. Their quick approval process is a big plus for borrowers in a hurry.

Pros and Cons

On the plus side, IIFL makes borrowing easy with minimal paperwork and flexible options. However, it might have slightly higher processing fees than some bank loans. Also, being a non-bank lender, it’s lesser known but still reliable.

Real-World Comparison

Imagine two friends need ₹10 lakh for different reasons. One chooses IIFL for faster approval and lower upfront fees. The other opts for a big bank with a longer approval process. The choice depends on what matters most: speed or perhaps a more familiar name.

Benefits of Choosing IIFL Personal Loan

Flexible Repayment Options

With EMIs tailored to your income, IIFL helps you pay comfortably. You can choose from various tenures to match your budget.

Minimal Documentation and Easy Application

The process is simple. With fewer papers and quick digital steps, you can get your loan approved fast.

Competitive Pricing

IIFL’s interest rates are often lower than many rivals, saving you money over time.

Customer Support and Transparency

IIFL offers clear information on fees and charges. Their customer support is dedicated to helping you through every step.

Tips for Responsible Borrowing and Managing Your Loan

Understanding the Total Cost of Borrowing

Before you borrow, check how much you will pay overall. Consider the interest rate and all fees involved.

Strategies for Timely Repayments

Set reminders or automate EMI payments. Never miss a due date to avoid penalties and damage to your credit score.

Prepayment and Foreclosure

Prepaying can save you interest but check if there are prepayment charges. Some lenders offer flexible prepayment options without extra fees.

Maintaining Good Credit Health

Regularly review your credit report. Keep your credit utilization low and stay within your repayment commitments.

Expert Insights and Industry Trends

Financial advisors suggest keeping loans manageable and avoiding over-borrowing. Borrowers are increasingly using apps and online platforms for faster access. Digital tools now help you compare loans, manage payments, and monitor your credit score easily.

Conclusion

Choosing the right personal loan is key to your financial goals. IIFL offers attractive benefits like competitive rates, quick approval, and flexible repayment options. Make sure you meet eligibility criteria and borrow responsibly. Always compare your options and understand total costs—this helps avoid surprises. Think of IIFL as a reliable partner, ready to support your financial needs.

Key Takeaways

- IIFL personal loans offer competitive interest rates, flexible tenure, and fast approval.

- Keeping a good credit score and providing complete documents will smoothen the process.

- Comparing interest rates and understanding total repayment helps in making smart decisions.

- Borrow responsibly by planning your EMIs and monitoring your credit health for a stronger financial future.