Loan Calculator Personal Loan

Discover Your Path to Financial Freedom: Master the Personal Loan Calculator

Personal loans can be an ideal way to help reach your goals, yet dealing with interest rates and payments can be daunting. That’s where personal loan calculators can come in! They give you all of the info necessary for smart decision-making: clarity regarding payments and interest totals as well as whether a loan fits within your budget constraints. Are you ready to take control? Get on it now!

Understanding Personal Loans

What exactly is a personal loan? They can be used for many things and being informed can help you determine whether this route is the one to follow.

What Is a Personal Loan? A personal loan is money borrowed from banks, credit unions or online lenders in return for payment over an agreed upon timeline with interest attached; how much of one you qualify for depends upon factors like your income level and creditworthiness.

Personal Loan Types

There are various kinds of personal loans. Secured loans require collateral such as your car or house as collateral. Unsecured loans don’t need this security but may come with higher rates due to not needing collateral at all; fixed-rate loans keep their same interest rate throughout; variable-rate loans change over time with market factors.

Common Uses for Personal Loans (PLs)

What can a personal loan help me do? Many things! Many use them to consolidate debt, consolidating several debts into one payment. Home improvements are another popular use. Unexpected medical costs or car repairs often arise unexpectedly as well – perhaps taking out a personal loan could provide that needed boost financially?

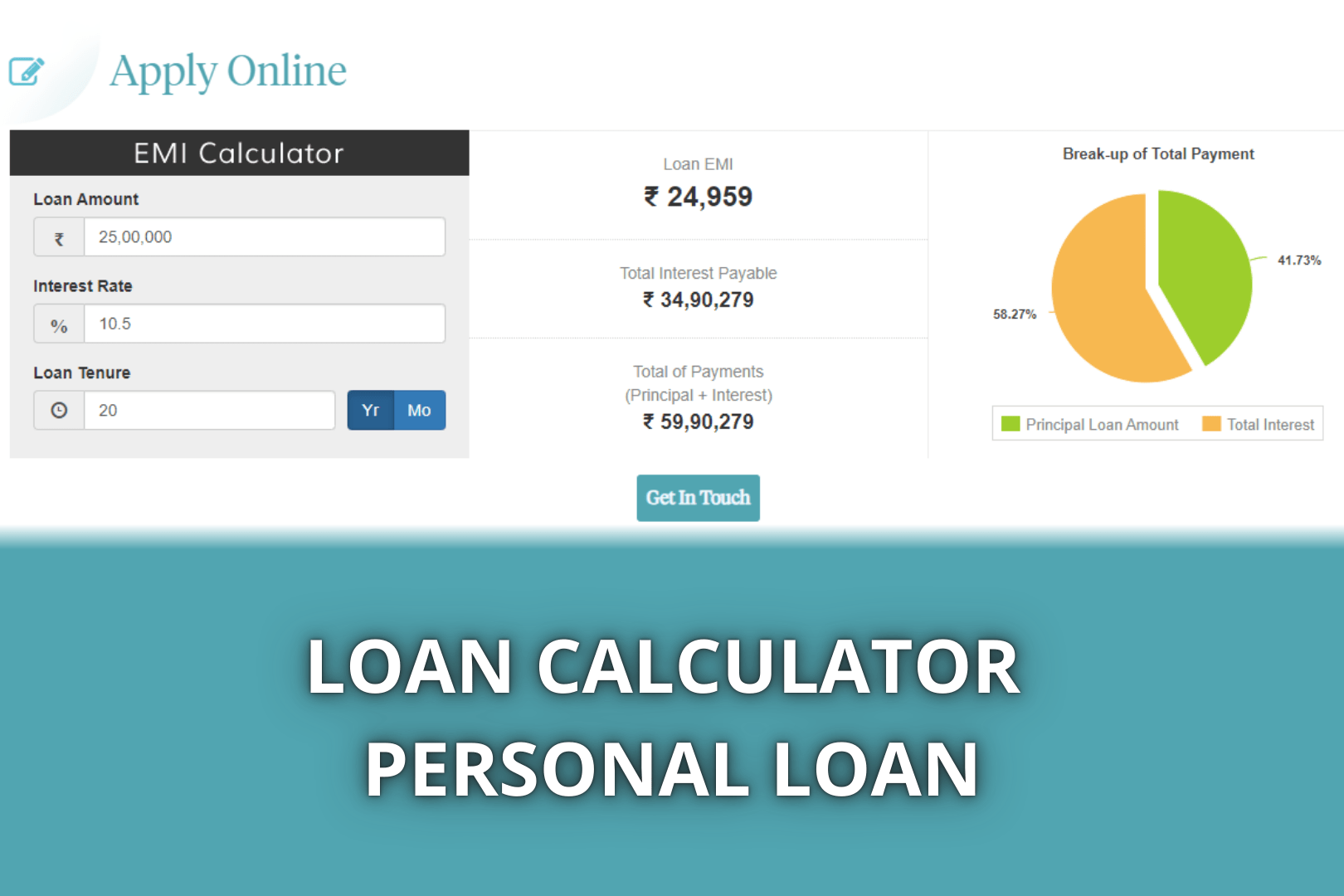

Understanding The Personal Loan Calculator

Personal loan calculators might seem complex at first, but with enough understanding it becomes an effective and straightforward tool. Let’s break this thing down!

Key Inputs of a Loan Calculator

The calculator requires some key pieces of information from you: Loan amount is how much money you intend to borrow; interest rate is what lenders charge to lend their funds, while loan term describes when your repayment will begin and add any costs such as origination fees or origination charges to account.

How the Calculator Works

Our calculator employs an elaborate formula to accurately determine your monthly payment and total interest amount, no need for memorization; just enter in accurate figures! Accurate input means more reliable outcomes.

Beyond the Basics: Advanced Features

Some calculators go the extra step and provide an amortization schedule, showing where each payment goes and providing insight into what might happen if extra payments were made each month. Visualizing different loan terms helps users select one best suited to them.

Utilizing the Personal Loan Calculator Efficiently

Are you ready to put this tool to use? Here’s how using a personal loan calculator will enable you to explore various scenarios and make informed choices.

Step-by-Step Guide to Utilizing a Loan Calculator

Let’s say you need a loan of $10,000 at an interest rate of 8% with repayment scheduled over 3 years, using this calculator will show your monthly payment. But try changing things around! What would happen if repayment were split over five years instead? Watch as your monthly payment changes accordingly.

Comparing Loan Offers

Shopping around for loans is smart. Take a moment and use our calculator to compare offers – one could offer lower interest but higher fees while another has longer terms that lower the monthly payment, potentially saving more in the long run. See which loan could save the most money over time!

Understanding Amortization Schedules

An amortization schedule is a table that details each payment’s allocation – how much goes towards interest vs how much towards paying down your loan principal over time. It shows you exactly how your loan balances get reduced with every passing month.

Avoiding Common Pitfalls

While using a personal loan calculator is straightforward, watch for these common errors to get accurate numbers.

Accurate Inputs

Erroneous input can produce inaccurate results! Make sure that when entering loan amounts, interest rates, or terms, that all details are entered correctly to avoid errors that skew results – even small mistakes could throw things off! Double check everything!

Avoid Ignoring Fees and Charges

Loans often incur fees such as origination charges, prepayment penalties and other charges which add up. Be sure to include this cost when using the calculator; otherwise you won’t get an accurate picture.

Focusing Only on Monthly Payments

An affordable monthly payment is great, but don’t base your decision solely on it. Consider all aspects of loan cost; longer repayment terms mean smaller monthly payments but greater interest over time.

Decisively Utilizing Your Loan Calculation System

Have the numbers at your fingertips. Now what? Use calculator results to see what is affordable, create a budget plan and negotiate more favorable loan terms.

Assess Your Affordability

Are You Really Able To Afford This Loan Before agreeing to take out a loan, take time to carefully consider your income and expenses to ascertain its affordability. Make an estimate of what monthly payment amount would comfortably fit within your budget – don’t stretch yourself too thinly as borrowing less and repaying easily could save more in interest over the long run.

Budgeting Loan Repayments

Once you obtain a loan, make the repayment an integral part of your budget and monitor spending closely to make payments on time. Prioritise activities which contribute more than they take away – for instance cutting back on non-essentials will ensure timely payments can be met.

Negotiate Better Loan Terms Now

Calculators give you power. By knowing exactly how much money you have available to you, lenders may negotiate to reduce interest rates or extend repayment terms – don’t be intimidated to ask! Don’t be afraid of asking!

Conclusion Utilizing a personal loan calculator puts you in control and provides clarity, control, and confidence when looking for loans that fit your specific needs. Explore options, compare offers, and select one with ease!

Key takeaways from using a loan calculator are simple. A personal loan calculator brings clarity, helps manage finances efficiently, and can give confidence when making financial decisions. Start using one today to take charge of your financial future!